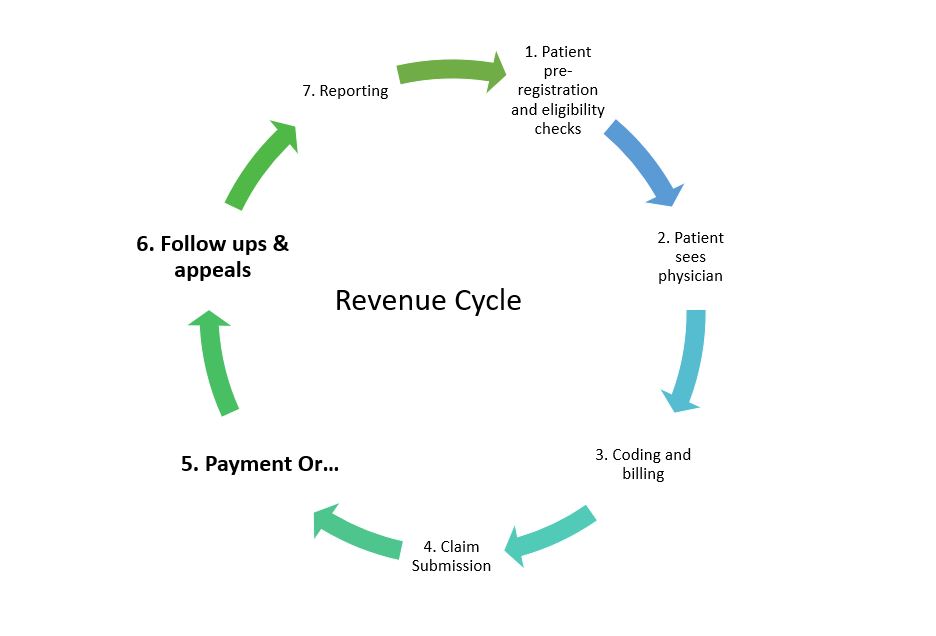

Once you submit a claim, what happens next? In the Revenue Management Cycle, after submitting a claim, it goes to the insurance payor, or a clearinghouse in some cases, and get processed. Once insurance receives the claim, they may take 30-45 days to process it. The time it takes for insurance to receive a claim can also vary depending on if you are submitting via mail or electronically.

To guarantee claims are being processed and you are updated on the progress of claims, follow up plays a crucial part.

What is A/R Follow Up

Accounts receivables (or A/R) for any organization means payments for services rendered that have not yet been received. If an organization supplies equipment, for example, and someone makes an order but will pay at a later date, that is recorded under accounts receivables.

For healthcare providers, a service rendered is billed out to insurance or the patient, and if the amount will be received at a later date, then that goes into accounts receivables.

A/R follow up is the process of keeping track of submitted claims, their status, and ultimately ensuring that there are no outstanding, unpaid claims. Whoever is doing the A/R follow up should know or be able to find out what claims are submitted and what the status of these claims are, including which ones have been processed, which ones are denied, and which ones need appeals. They should also know or be able to research why claims are denied and what needs to be done to solve this.

Why Is A/R Follow up important?

To understand why this process is so crucial, here are some situations that could happen with your insurance claims once they are submitted:

- Claims that are still being delivered to the insurance company

- Claims were never received by Insurance

- Claims that are still unprocessed by insurance

- Claims requiring additional information to be processed

- Claims are denied and may require appeals

- Paid claims

All of these are scenarios that could happen once insurance receives a claim. They could pay it, in which cases you should also be aware of this to record payments. They could also deny or require more information. All of this means that it is very important to keep updated on the status of claims.

When your healthcare practice sees multiple patients a day, it is crucial to keep track of when claims are billed and when you or your team should follow up. Some claims could be sent out one day and others are already received by insurance the next, depending on when your facility bills. With many different claims for different patients, this is another reason to it is important to keep track and follow up on claims.

Without timely follow up, you could face the following situations:

- Unaware of claims that have never been received by insurance

- Unaware of claims that were paid or denied

- Missed timely filing period for appeals

- Unaware some claims require additional information so it is long outstanding and unpaid, etc.

To avoid these circumstances and to overall maintain the financial health of your practice, be sure to dedicate the time and a proper system for A/R follow up.

Having an A/R follow up team is important as it ensures focus is put on this very important task. At Americare Network, apart from our billing team, we have a team of very dedicated individuals working to follow up on your claims so that you can receive payment in a timely manner. Contact us today to learn more about how we can help your facility with billing and collections, as well as our additional financing, credentialing, and chronic care management services.