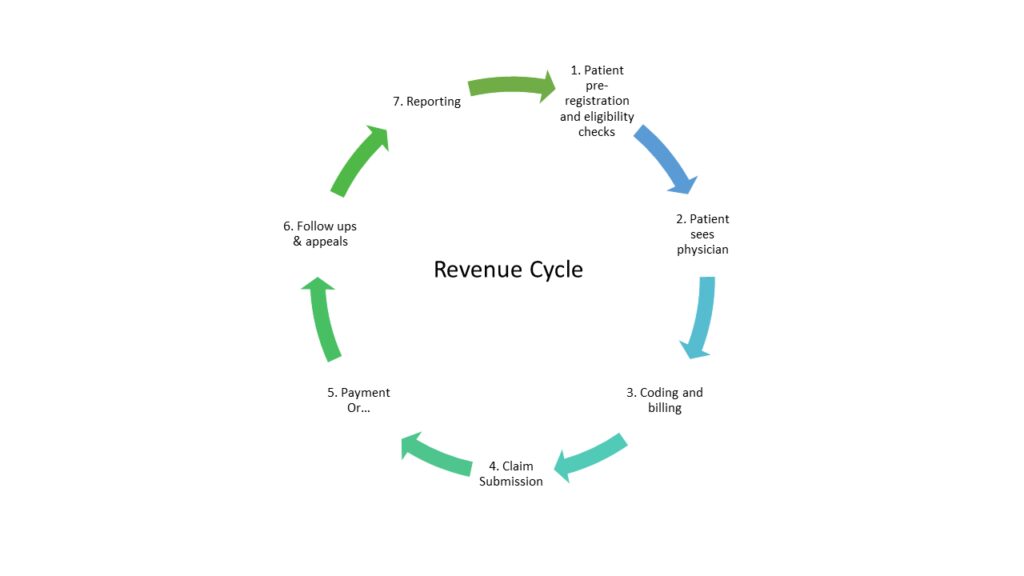

The Revenue Cycle is the collection of processes involved in generating revenue for healthcare services. This cycle can include steps such as checking a patient’s insurance eligibility to submitting claims and reporting payments. Each step is crucial.

Revenue cycles could look like this:

But why is the revenue cycle important?

The revenue cycle from start to end can take a considerable amount of time. The insurance payor alone can take up to 45 days to decide on payments. Altogether, it could take more than a month to receive payment. Therefore, it is crucial to manage the cycle properly to ensure revenue is received in a timely manner. Quicker payments can lead to improved working capital towards, for example, daily operations or expanding your practice.

As well, management consulting company, McKinsey & Company, published this article in 2018 explaining the need to take revenue cycle management even further a step to what they call “revenue excellence”, further highlighting the importance of a stable revenue cycle.

How To Improve?

The revenue cycle is, for lack of a better word, cyclical. It is important to complete each step continuously.

How to shorten the cycle?

- Timely claim submissions – insurance adjudication process can take 30-45 days, so submit claims as soon as possible. Shorten the time between patient visits and insurance payments by making timely claims.

- Timely follow ups and appeals – if a claim is denied, follow up quickly to determine the reason and resubmit the claim if possible. This can also help to decrease the revenue cycle time.

- Combat errors and denials – according to the McKinsey report, the American Hospital Association has found that some common reasons for claim denials include incorrect coding and insufficient documentation. Pay attention to details when submitting claims to ensure minimal error and decrease likelihood of denials.

Try these tips to improve billing and the revenue cycle.

There are many steps involved in the revenue cycle and it is important to optimize each step. Improving revenue cycle management can help the practice generate revenue better and provide more resources to help support everyday operations.

Americare Network and Medical Financing

On top of delivering customized and optimized medical billing solutions to help improve practice’s cash flow, Americare Network also offers a unique medical financing service. This service allows your practice to receive a line of credit and get access to funds quicker*. Our team of certified professionals will assist you with your revenue management needs and discuss ways that repayment plans can be customized to your individual practice. Our combined services can help your practice generate the income it needs so you can focus on what you do best…care for your patients. Reach out to us today!

*All Medical Financing arrangements require personal and business background/credit checks.