Working Capital Management

Research into hospitals’ finances and performance show that there is indeed a correlation. Finances are an important part of medical practices and working capital just one measure of financial health that is important to focus on.

What is Working Capital?

In a previous post, we talked about what working capital is and why it is important. As a quick recap, working capital is the difference between current assets and current liabilities. It is a measure of an organization’s financial health.

Current Assets – Current Liabilities = Net Working Capital

For more details on working capital, you can read about it in here.

But how exactly do you go about improving working capital at your healthcare practice?

How to Manage Working Capital?

The key is to manage your organization’s net working capital and make sure there is enough assets to cover liabilities. This can be done by managing both parts of the equation, paying attention to cash inflow and outflow.

In this post we will briefly talk about how to manage liabilities, but the focus will be on improving current assets as it pertains to medical billing and collections.

Managing Liabilities

Current liabilities are one part of the net working capital equation. These could include:

- Purchasing supplies on credit

- Wages payable

- Income tax owed within a year

Basically, any item your organization must pay to another party within a year.

To manage liabilities, regulate short term debt payments using electronic payment mechanisms. Keep payment records organized and make payments in a timely manner. Make sure short-term payments to another party do not accumulate in that account.

By managing a payment schedule, it reduces the risk of not paying on time and increasing the payable amount the next time you make a payment.

Managing Current Assets

On the other hand, current assets for healthcare practices can include the following:

- Cash

- Accounts receivables (patient’s billed, unpaid claims)

- Supplies (items that will be used up in the short term eg. gloves)

With specific regards to medical billing and the healthcare practice, an important part of current assets for healthcare practices are unpaid bills. When a patient visits your practice, the service is not always paid right away. Instead, you submit a claim to an insurance payor. In the 30-45 days before the payment is made, the amount billed is an accounts receivable. Your practice will receive this amount, but it will happen in the near future.

One method to increase current assets is to improve your revenue management cycle. On this topic, researchers have found a relation between hospitals’ revenue management cycle and their profitability. Improving this cycle can increase the number of claims billed in a timely manner. As well, when speeding up the billing process, the time between claim submission and collection can decrease.

In addition, work to improve the accuracy of your practice’s claim submissions. Study any changes in medical billing practices, different insurance policies, and keep a keen eye out for details on your submitted claims. The more accurate your claims are, the less likely the claim will be denied. For example, check the patient’s insurance eligibility before billing and ensure they are covered by an insurance payor. As well, make sure submissions are filled out correctly. Paying attention to details and billing in a timely manner can help to increase the speed of payment collections.

Billing claims continuously and receiving payment efficiently increases both accounts receivables and cash inflows. This can help your organization manage its working capital. Through more timely cash inflows, your organization will be more capable to make short term payables.

Financing

Another way to increase assets, one that we offer at Americare Network, is something we call medical financing. While the terms of financing can differ based on which institution it is offered at, it is essentially receiving a loan to help improve your ability to operate. This can help to improve cash inflows in the short term, allowing your organization to have sufficient cash to manage your working capital.

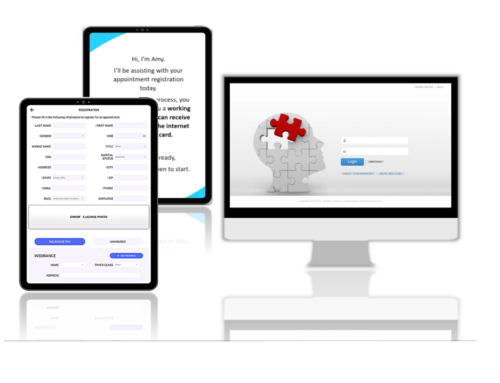

Medical Financing at Americare Network

At Americare Network, we offer medical financing lines of credit for your practice. This service is unique to clients who work with us. Specifically, it can help practices who:

- May be too new to obtain bank financing.

- Require immediate funds or one-time payroll.

- Need to expand their practice and/or working capital.

- Need to purchase new equipment or facilities.

With more than 25+ years of industry experience and solid financial backing, Americare Network offers a line of credit financing option unique to our medical billing clients. Find out more here.